What will happen if PAN is not linked with Aadhaar: How to Check & Link?

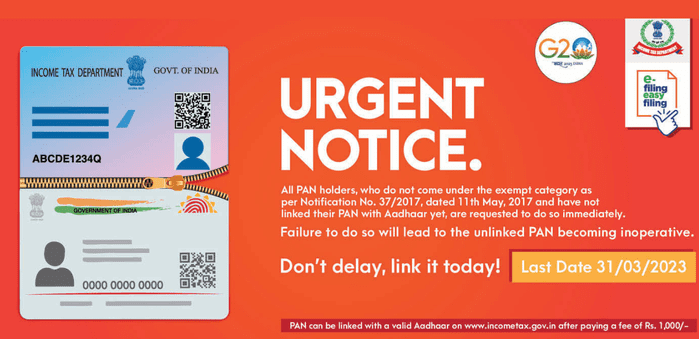

Central Board of Direct Taxes (CBDT), the apex regulatory body for direct tax and duties has instructed all taxpayers on the compulsory link of the Aadhaar number with a PAN Card number, by March 31, 2023.

As per Section 139AA of the Income Tax Act 1961 and CBDT circular F. No. 370142/14/22-TPL dated 30th March 2022, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by the end of 30th March 2023.

Why do You need to link Your Aadhaar with your PAN?

As per the Government, new rules for the compulsory linking of PAN cards and Aadhaar cards were instructed primarily to reduce the incidence of duplicate PAN cards, which paves way for inaccurate calculation and collection of taxes.

While on the other hand having, multiple PAN cards for the same person makes it difficult for the authorities to track tax evasion. To avoid such problems Govt has taken the steps to improve compliance and reduce tax evasion in the country.

What will happen if the PAN is not linked with Aadhaar by 31 March 2023?

Though not linking the Aadhaar Card with your PAN card will have multiple consequences but if you fail to link your Aadhaar with your PAN by March 31, 2023, the first thing that will happen, is the 10-digit unique alphanumeric number of your PAN card will become inoperative. And let’s find out what are the other disadvantages and penalties you will attract not linking both of them.

- Your PAN will become inoperative until linked with your Aadhaar.

- TDS/TCS deduction will attract a higher rate applicable to PAN not present.

- Investors will not be able to carry out any transactions in NSE or BSE.

Apart from the above three main consequences, you will not be able to perform given below banking services:

- Booking a Fixed Deposit above Rs. 50,000.

- Depositing cash above Rs. 50,000.

- Obtaining a new Debit/Credit Card.

- Investing or redeeming your Mutual Funds.

- Purchasing any foreign currency beyond Rs 50,000.

Taxpayers who have not yet linked their Aadhaar with their PAN can do so by paying a late fee of Rs 1,000, as the deadline for linking without penalty was June 30, 2022.

In addition to the tax department, the Securities and Exchange Board of India (SEBI), the capital market regulator, has also mandated the linking of Aadhaar with PAN.

Don’t worry the last date is 31, March 2023 and you can link your Aadhaar card with your PAN online easily just by following the few steps mentioned in the later section. But before starting to link both, check whether your PAN card is linked with your Aadhaar card or not.

How to Check Aadhar Linked with PAN Card or Not?

Step 1: Go to the Income Tax e-Filing portal.

Step 2: Now under Quick Links click Link Aadhaar Status.

Step 3: Enter your PAN and Aadhaar Number, and click View Link Aadhaar Status.

On successful Validation, a message will be displayed regarding your Link Aadhaar Status. If your Aadhaar is linked with your PAN, it will show already linked. However, if not, then it will show PAN is not linked with Aadhaar, and you can link easily.

How to Link Pan Card with Aadhar Card Online?

Step 1: First of all open the Income Tax e-Filing portal.

Step 2: Now click on the “Link Aadhaar” option.

Step 3: Here you need to fill in your PAN and Aadhaar number, and name as per Aadhaar in the required fields.

Step 4: Now click on validate to verify the details and submit the form.

Once the linking is successful, a confirmation message will appear on the screen, and you will receive an OTP on your registered mobile number.

However, there are a few categories of people who are exempted from Aadhaar-PAN linking, You can check below the list of categories.

(i) NRIs

(ii) Not a citizen of India

(iii) age > 80 years as of the date

(iv) State of residence is ASSAM, MEGHALAYA or JAMMU & KASHMIR

Summing-up

The last date for linking the Aadhar with PAN has been given for many years. The central government and Income Tax department have already given enough time to everyone link their PAN with Aadhaar but people are not serious about such things.

But this time Government has given strict instructions to the Central Board of Direct Taxes to take actions like levy penalties or impose other restrictions where PAN is very often used. So what are you waiting for, just check whether it is linked if not, follow the steps given above.